Argent Minerals Limited is an ASX-listed public company focused on creating shareholder wealth through the discovery, extraction and marketing of precious and base metals. A key goal of the Company is to become a leading Australian polymetallic producer. The Company’s project assets are situated in the Lachlan Orogen in New South Wales, Australia, a richly mineralised geological terrane extending from northern NSW and the highly prospective Gascoyne Region, Western Australia.

Argent Minerals’ two projects, in each of which the Company owns 100% interest, is strategically positioned within a compelling neighbourhood which hosts world-class deposits including one of the largest underground copper-gold mines in the southern hemisphere, Newcrest’s Cadia Valley Operations in NSW. The WA assets lie proximal to HAS -Hastings Technology Metals, Dreadnought, Fortescue Metals and Rio Tinto Limited.

Currently the company’s tenement package cover over 1,000 km2 in Western Australia targeting Cu-Ni-REE-PGE and Cu-Pb-Zn-Ag within 175km2 in New South Wales. The company also has the Kempfield Deposit currently estimated under the 2012 JORC Code at 52 million ounces silver equivalent of silver, lead, zinc & gold

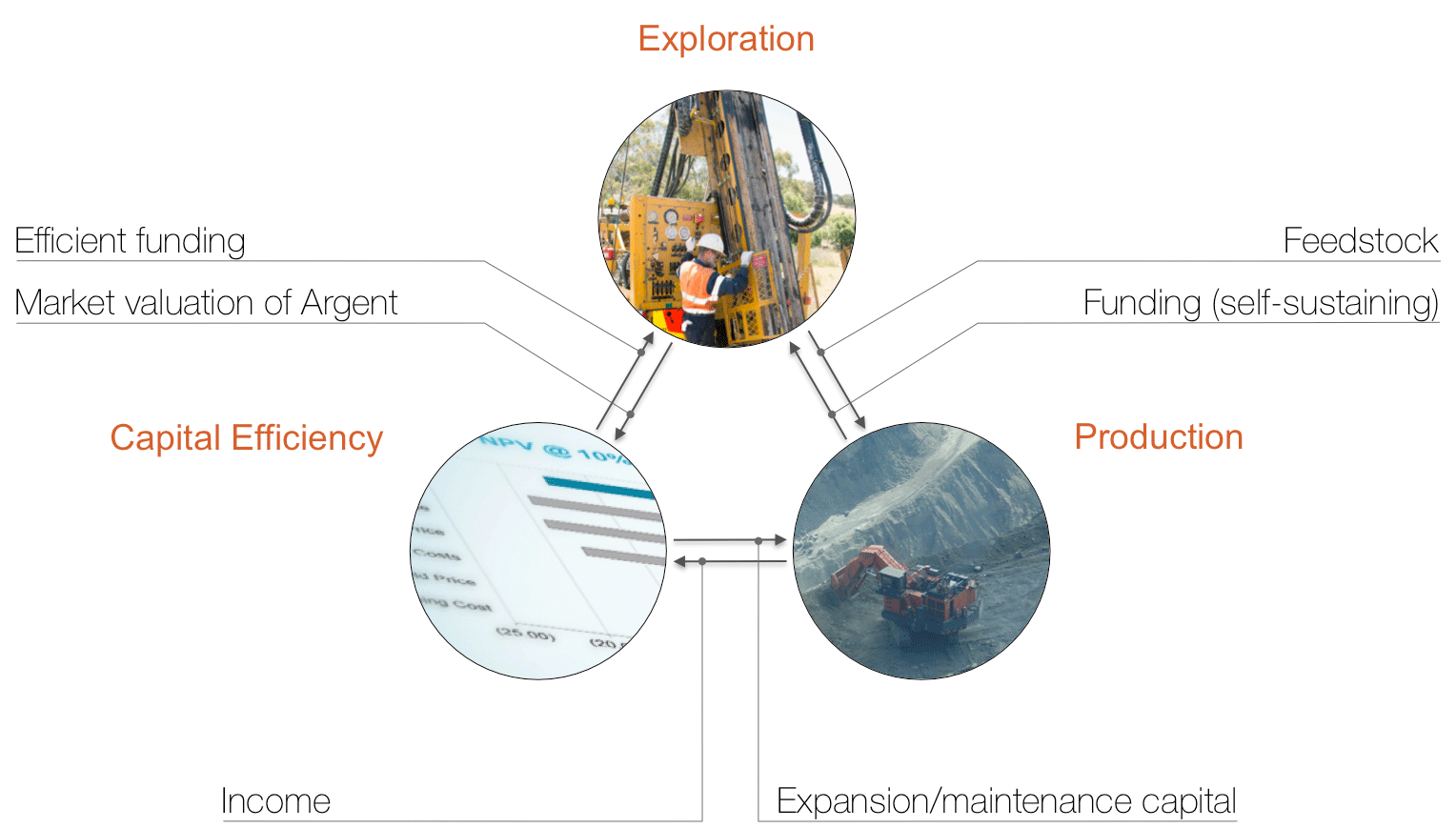

1. Exploration

Argent Minerals is aggressively pursuing the significant exploration upside potential that it has identified at the Kempfield Polymetallic Project, a registered NSW State Significant Development. Owned 100% by Argent Minerals, Kempfield is the Company’s flagship project with a substantial Mineral Resource of 52 million ounces of silver equivalent of lead, zinc, silver and gold at a silver equivalent grade of 75 g/t Ag Eq that has been recently upgraded to JORC 2012 standard.

Tonnes and grade are key factors in any project economics, and Argent’s focus is to add both where opportunities exist to do so, particularly where this might add to the Company’s base and precious metal resources. Grades of up to 17.9% combined lead/zinc have been identified immediately to the west of the existing Mineral Resource, where exploration vectors point to the potential for multiple additional Volcanogenic Massive Sulphide (VMS) lenses and a feeder zone.

The timing of this development coincides strategically with market forecasts of a world wide shortage of zinc and significant zinc price increases on the London Metals Exchange (LME).

Whilst Argent Minerals has established an initial goal of discovering an additional 5 million tonnes at Kempfield with higher grade lead/zinc, silver, gold and potentially, copper, the potential for a much larger system and associated world-class discovery has been identified. Successful exploration of this opportunity will be a game-changer with ‘company maker’ potential for Argent Minerals.

Argent is finalising preparations for drilling these new target areas, and the Company has achieved a significant breakthrough in geophysics for delineating these targets. MagnetoMetric Resistivity (MMR) surveys have yielded a strong correlation with known lead/zinc mineralisation at Kempfield, a relatively poor conductor which is not readily identifiable by traditional electromagnetic surveys. This recent breakthrough means that a new, highly specific geophysical tool has become available for the low cost delineation of lead/zinc targets at Kempfield in preparation for diamond drilling, as a strategic complement to Argent’s methodical approach to base and precious metals exploration at Kempfield.

Argent has earned 78% in the West Wyalong Project, following the drilling of the identified porphyry copper-gold magnetic survey targets. The Company is now in the process of earning a further 12% for a 90% share in project equity through further exploration expenditure.

The local government body, the Bland Shire Council, has welcomed these developments and has publicly indicated its strong support for Argent and the prospect of a new copper-gold mine in the area.

The Company has also earned a 70% interest in the historic Sunny Corner silver mine, which in the late 1800s produced silver ore so rich that it was classed as ‘Direct Shipping Ore’.

2. Income Generation Through Mining Production

As Argent pursues the exploration for base and precious metals to realise its goal of mining production, the low-cost silver-gold heap leach operation for which an Environmental Impact Statement (EIS) was submitted to the NSW Government in April 2013 remains in place as a fast-response, market-ready option, to take advantage of any precious metal pricing recovery that may occur. In the event that the precious metals pricing recovers to the levels prevailing prior to the EIS submission, Argent is well positioned to progress this plan through a rapid approval process and toward the commencement of production revenue, as an optional first stage along the growth path to a leading polymetallic producer.

3. Capital Efficiency

In addition to having relatively low costs, Argent has developed a track record in capital-efficient funding. More than 2.9 million in funding has been raised through the Company’s R&D claims, with a considerable portion of these funds being reinvested directly into project value.

Since September 2014, Argent has been awarded $550,000 in heavily contested NSW Government funding to drill-test the significant exploration upside identified at the Kempfield Polymetallic Project, Loch Lilly and West Wyalong exploration projects. The Company intends to continue to pursue capital efficient funding methods.

Keep watching for ASX announcements or subscribe here for alerts.